How to Request a Tax Credit

For every donation you make above five dollars, you are able to claim 33.33% back from the IRD (Inland Revenue Department) as a tax credit. You can even choose to transfer that credit back to us to cover the administrative cost of Knowledge Bank. This turns a $100 donation into a $133 donation. It’s a great way to make your donation go even further and is a huge help!

You can process your donation tax credit online using the tax receipt we send you. It’s possible to claim for donations from up to four years ago if you have not already done so.

To submit your receipt online, you will need a myIR login. If you don’t have one, registering is easy (you’ll need your IRD number).

A step by step guide

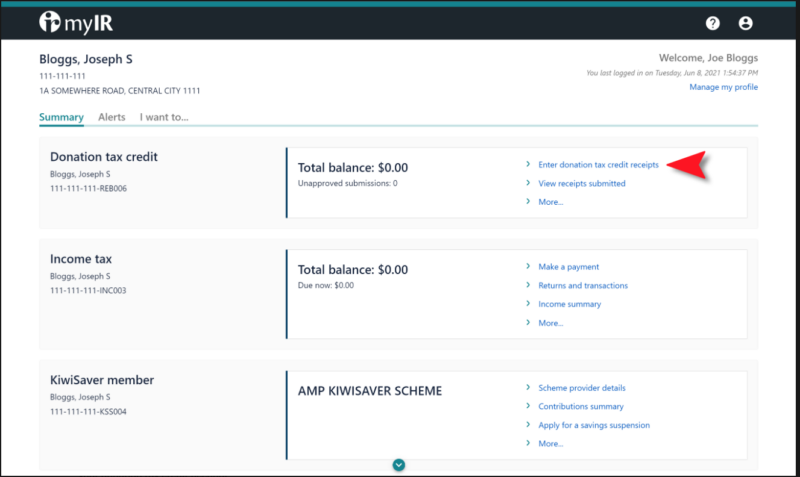

1. Register for, or log in to, your myIR account.

If you do not have a myIR account, when you are signing up make sure to request you want to be able to receive donation tax credits.

If you have a myIR account but ‘Donation tax credit’ is not an option on your home page, you can add it by going to ‘I want to…’, then ‘Register for donation tax credit’, and fill in the registration form then submit it to the IRD.

Once you have the ‘Donation tax credit’ option on your home page, select Enter donation tax credit receipts in your donation tax credit account.

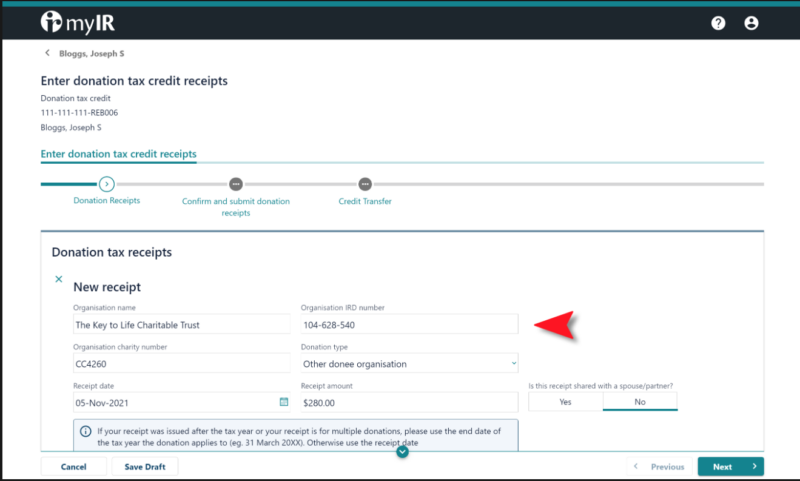

2.Add receipt details and attach proof.

Click + Add a receipt and fill in the details.

Organisation name: Knowledge Bank

Organisation IRD number: 109-899-320

Organisation charity number: CC446497

Donation type: Other donee organisation

Receipt date: Add the date that is on your receipt

Receipt amount: Add the donation amount that is on your receipt

Is this receipt shared with a spouse/partner: Yes or No (if you answer Yes, the IRD number of your partner must also be entered as well)

Click Add receipt attachment.

Document description: Knowledge Bank Donation Receipt

File: Upload your donation receipt pdf (you can download a copy of the donation receipt as a pdf from within the receipt email)

Click OK and then click Next >

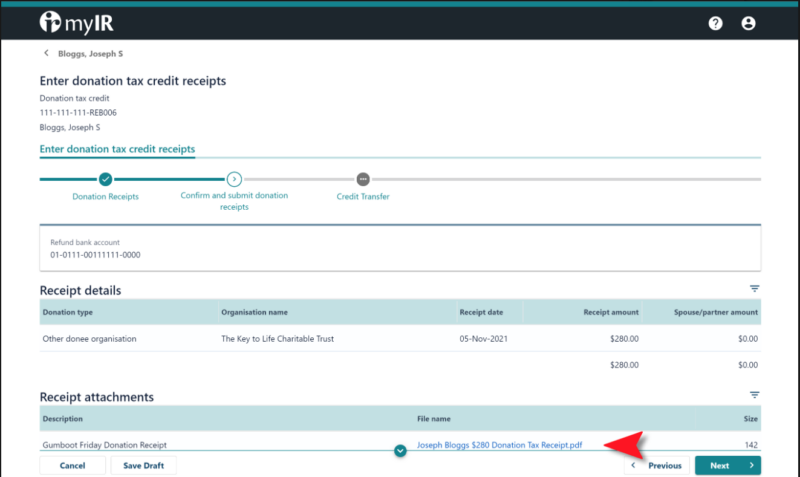

3. Confirm details are correct before proceeding.

Double check all the information has been entered correctly.

If everything looks correct, click on Next > again.

If you need to fix anything, click < Previous and correct any details.

Or you can choose to save progress and complete the submission later by clicking Save Draft.

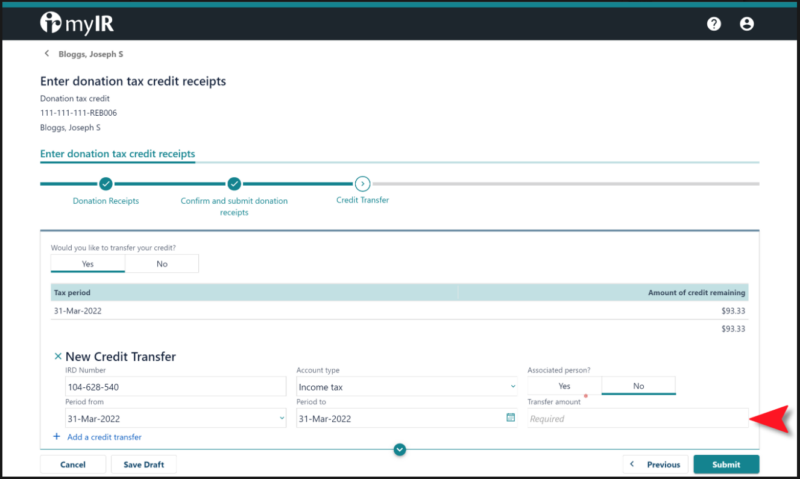

4. Choose whether to transfer the donation tax credit.

To allocate all or even part of the credit back to us (❤️ you’re fantastic!), select Yes.

IRD number: 109-899-320

Account type: Income tax

Associated person: No

Period from: Select the first date in the list

Period to: Add the same date you selected in ‘Period from’

Transfer amount: Add the amount you are transferring

5. Submit it for processing.

That’s it, now click on Submit.