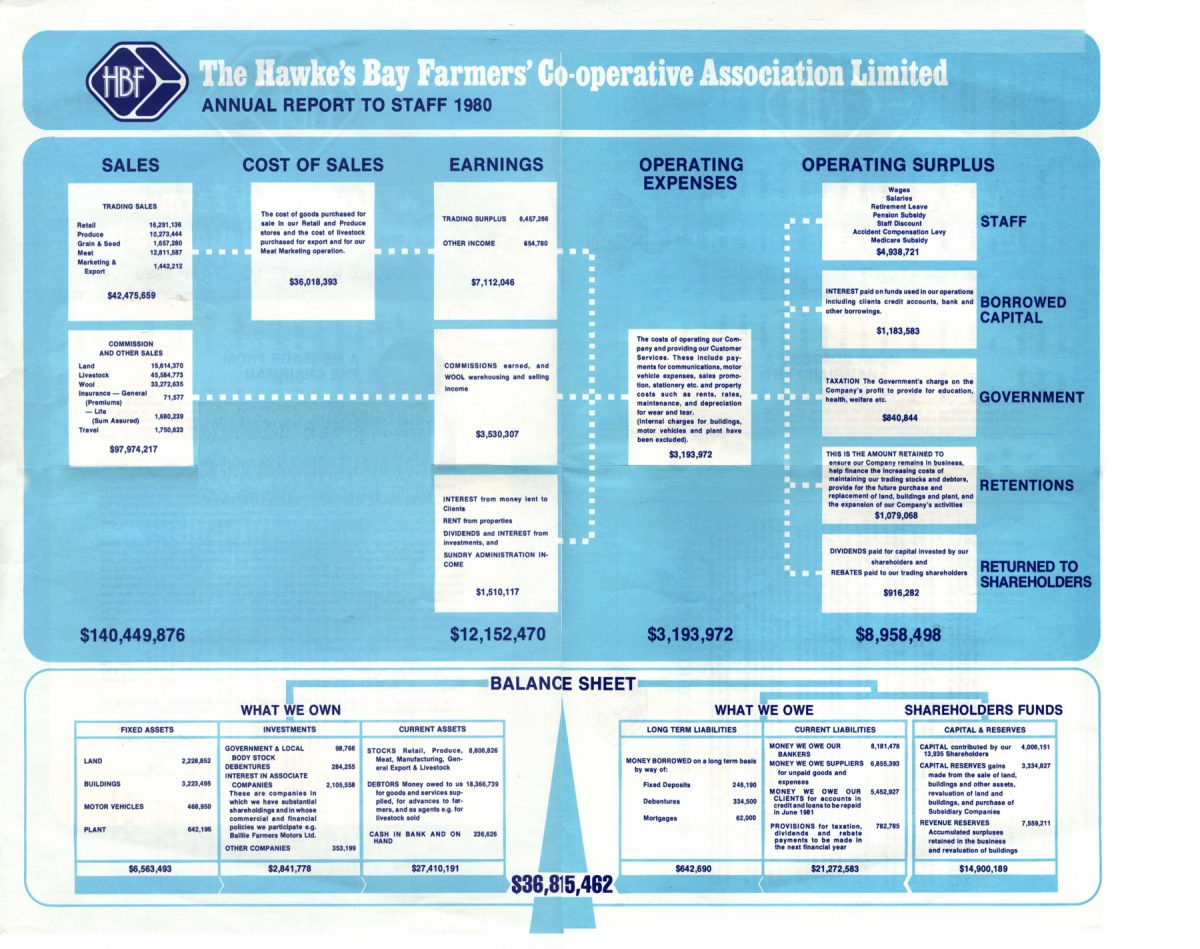

HBF

The Hawkes Bay Farmers’ Co-operative Association Limited

ANNUAL REPORT TO STAFF 1980

SALES

TRADING SALES

Retail 16,291,136

Produce 10,273,444

Grain & Seed 1,657,280

Meat 12,811,587

Marketing & Export 1,442,212

$42,475,659

$140,449,876

COMMISSION AND OTHER SALES

Land 15,614,370

Livestock 45,584,773

Wool 33,272,635

Insurance – General (Premiums) 71,577

– Life (Sum Assured) 1,680,239

Travel 1,750,623

$97,974,217

COST OF SALES

The cost of goods purchased for sale in our Retail and Produce stores and the cost of livestock purchased for export and for our Meat Marketing operation.

$36,018,393

EARNINGS

TRADING SURPLUS 6,457,266

OTHER INCOME 654,780

$7,112,046

COMMISSIONS earned, and WOOL warehousing and selling income

$3,530,307

INTEREST from money lent to Clients

RENT from properties

DIVIDENDS and INTEREST from investments, and SUNDRY ADMINISTRATION INCOME

$1,510,117

$12,152,470

OPERATING EXPENSES

The costs of operating our Company and providing our Customer Services. These include payments for communications, motor vehicle expenses, sales promotion, stationery etc. and property costs such as rents, rates, maintenance, and depreciation for wear and tear.

(Internal charges for buildings, motor vehicles and plant have been excluded).

$3,193,972

$3,193,972

OPERATING SURPLUS

STAFF

Wages

Salaries

Retirement Leave

Pension Subsidy

Staff Discount

Accident Compensation Levy

Medicare Subsidy

$4,938,721

BORROWED CAPITAL

INTEREST paid on funds used in our operations including clients credit accounts, bank and other borrowings.

$1,183,583

GOVERNMENT

TAXATION The Government’s charge on the Company’s profit to provide for education, health, welfare etc.

$840,844

RETENTIONS

THIS IS THE AMOUNT RETAINED TO

ensure our Company remains in business, help finance the increasing costs of maintaining our trading stocks and debtors, provide for the future purchase and replacement of land, buildings and plant, and the expansion of our Company’s activities

$1,079,068

RETURNED TO SHAREHOLDERS

DIVIDENDS paid for capital invested by our shareholders and

REBATES paid to our trading shareholders

$916,282

$8,958,498

BALANCE SHEET

WHAT WE OWN

FIXED ASSETS

LAND 2,228,852

BUILDINGS 3,223,495

MOTOR VEHICLES 468,950

PLANT 642,196

$6,563,493

INVESTMENTS

GOVERNMENT & LOCAL BODY STOCK 98,766

DEBENTURES 284,255

INTEREST IN ASSOCIATE COMPANIES 2,105,558

These are companies in which we have substantial shareholdings and in whose commercial and financial policies we participate e.g. Baillie Farmers Motors Ltd.

OTHER COMPANIES 353,199

$2,841,778

CURRENT ASSETS

STOCKS Retail, Produce, Meat, Manufacturing, General Export & Livestock 8,806,826

DEBTORS Money owed to us for goods and services supplied, for advances to farmers, and as agents e.g. for livestock sold 18,366,739

CASH IN BANK AND ON HAND 236,626

$27,410,191

WHAT WE OWE

LONG TERM LIABILITIES

MONEY BORROWED on a long term basis by way of:

Fixed Deposits 246,190

Debentures 334,500

Mortgages 62,000

$642,690

CURRENT LIABILITIES

MONEY WE OWE OUR BANKERS 8,181,478

MONEY WE OWE SUPPLIERS for unpaid goods and expenses 6,855,393

MONEY WE OWE OUR CLIENTS for accounts in credit and loans to be repaid in June 1981 5,452,927

PROVISIONS for taxation, dividends and rebate payments to be made in the next financial year 782,785

$21,272,583

SHAREHOLDERS FUNDS

CAPITAL & RESERVES

CAPITAL contributed by our 13,935 Shareholders 4,006,151

CAPITAL RESERVES gains made from the sale of land, buildings and other assets, revaluation of land and buildings, and purchase of Subsidiary Companies 3,334,827

REVENUE RESERVES

Accumulated surpluses retained in the business and revaluation of buildings 7,559,211

$14,900,189

$36,815,462

Do you know something about this record?

Please note we cannot verify the accuracy of any information posted by the community.