- Home

- Collections

- MORGAN JE

- Local History

- Regional Overview 1998

Regional Overview 1998

HB regional overview 1

Major Urban Centres

Population <15% 15-24% 25-44% 45-64% 65+% Average Household Income

Auckland 890,682 22.6 17.1 31.9 17.9 10.4 $39,129

Wellington 323,181 22.0 18.0 33.2 17.7 9.0 $42,341

Christchurch 302,517 19.6 17.6 30.4 19.0 13.3 $33,756

Hamilton 145,566 23.6 19.0 29.9 17.4 10.1 $36,115

Napier/Hastings 108,795 23.9 15.7 28.2 19.3 12.9 $31,976

Dunedin 107,139 19.3 21.1 28.7 17.8 13.0 $32,619

Palmerston North 83,349 21.7 21.9 29.2 16.4 10.8 $35,171

Tauranga 70,092 21.3 13.7 27.5 20.8 16.6 $31,992

Invercargill 51,330 24.5 16.3 30.2 17.5 11.5 $33,234

New Plymouth 47,493 23.1 15.1 29.6 18.3 13.9 $33,933

Nelson 45,654 20.5 15.3 29.5 20.0 14.7 $33,012

Source: Statistics NZ.

population

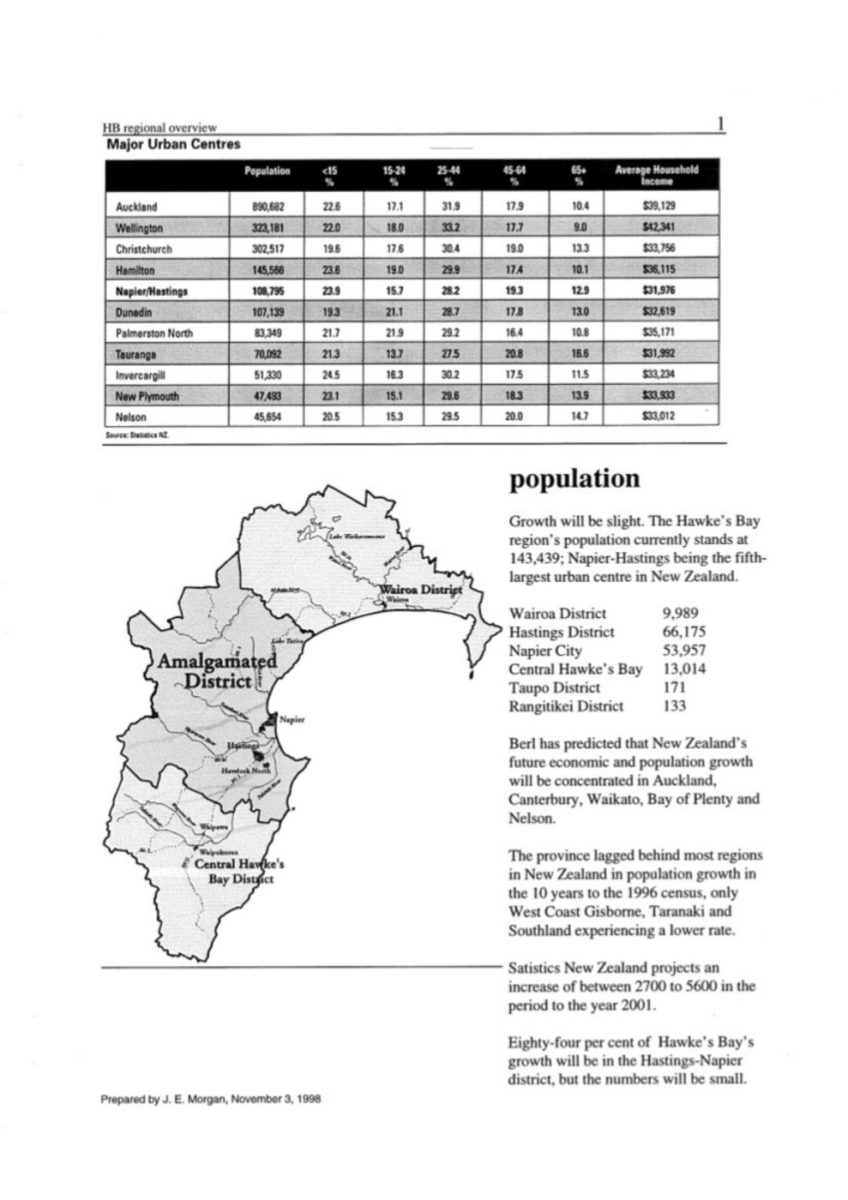

Growth will be slight. The Hawke’s Bay region’s population currently stands at 143,439; Napier-Hastings being the fifth-largest urban centre in New Zealand.

Wairoa District 9,989

Hastings District 66,175

Napier City 53,957

Central Hawke’s Bay 13,014

Taupo District 171

Rangitikei District 133

Berl has predicted that New Zealand’s future economic and population growth will be concentrated in Auckland, Canterbury, Waikato, Bay of Plenty and Nelson.

The province lagged behind most regions in New Zealand in population growth in the 10 years to the 1996 census, only West Coast Gisborne, Taranaki and Southland experiencing a lower rate.

Statistics New Zealand projects an increase of between 2700 to 5600 in the period to the year 2001.

Eighty-four per cent of Hawke’s Bay’s growth will be in the Hastings-Napier district, but the numbers will be small.

Prepared by J. E. Morgan, November 3, 1998

HB regional overview 2

trade

Hawke’s Bay depends predominantly on what it can grow: pastoral farming, fruitgrowing, process cropping, market gardening, viticulture, forestry.

Accordingly, it is subject to the vagaries of the international marketplace. Forecasts in late October of recession in Europe and the United States were early warnings of more trouble ahead for an export sector already hard hit by the 16-month-old Asian financial crisis.

Britain and the US are predicted to go into recession in the middle of next year. Reports from Europe say the spreading Asian contagion has begun to slow growth in that region.

Slumps in commodity prices and a slowdown in drought-affected exports can only worsen Hawke’s Bay’s lot, if the predicted recessions occur.

production statistics

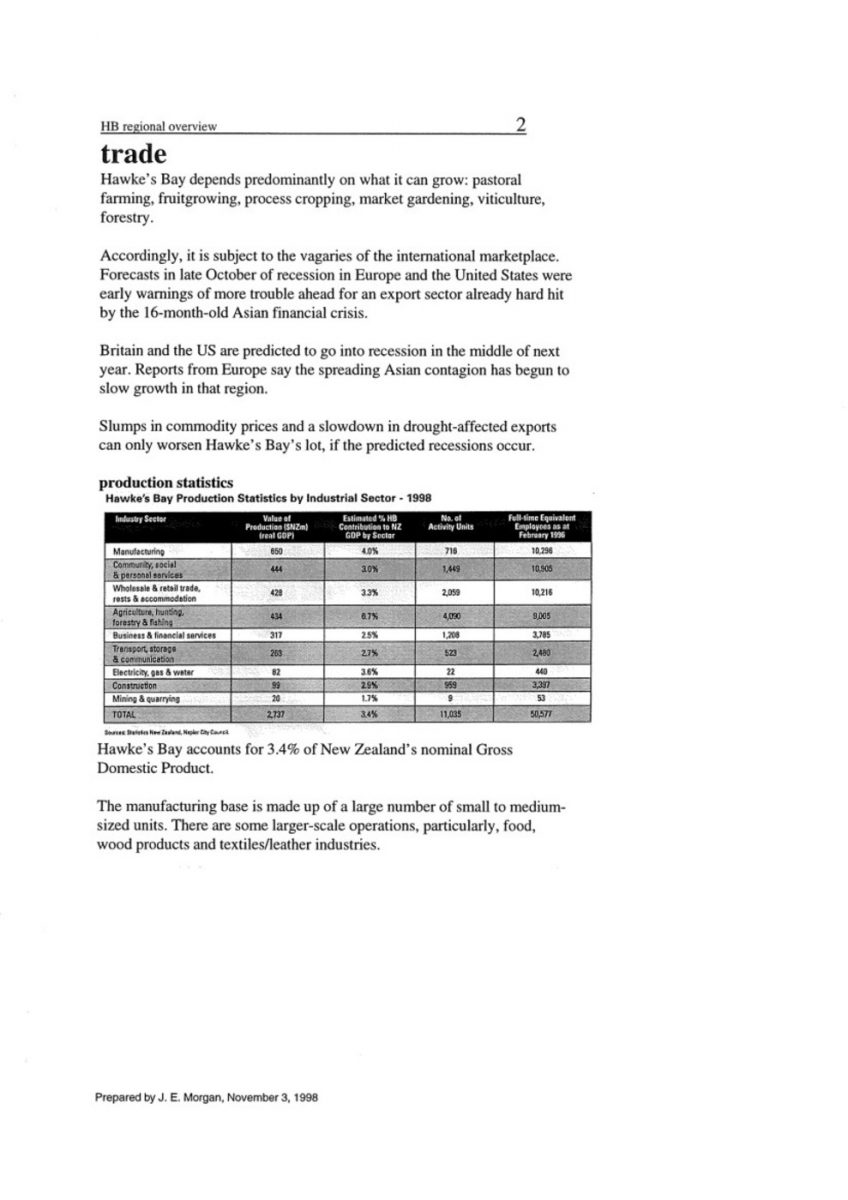

Hawke’s Bay Production Statistics by Industrial Sector – 1998

Industry Sector Value of Production ($NZm) (real GDP) Estimated % HB Contribution to NZ GDP by Sector No. of Activity Units Full-time Equivalent Employees as at February 1996

Manufacturing 650 4.0% 716 10,296

Community, social & personal services 444 3.0% 1,449 10,905

Wholesale & retail trade, rests & accommodation 428 3.3% 2,059 10,216

Agriculture, hunting, forestry & fishing 434 6.7% 4,090 9,005

Business & financial services 317 2.5% 1,208 3,785

Transport, storage & communication 263 2.7% 523 2,480

Electricity, gas & water 82 3.6% 22 440

Construction 99 2.9% 959 3,397

Mining & quarrying 20 1.7% 9 53

TOTAL 2,737 3.4% 11,035 50,577

Sources: Statistics New Zealand, Napier City Council

Hawke’s Bay accounts for 3.4% of New Zealand’s nominal Gross Domestic Product.

The manufacturing base is made up of a large number of small to medium-sized units. There are some larger-scale operations, particularly, food, wood products and textiles/leather industries.

Prepared by J. E. Morgan, November 3, 1998

HB regional overview 3

pastoral farming

East Coast Stock numbers 1998

Stock Type Numbers in East Coast 1998*

Sheep 9.6m

Beef cattle 1.0m

Dairy cattle 0.2m

Deer 0.2m

* Includes Hawke’s Bay, plus the neighbouring Gisborne and Wairarapa regions.

Source: New Zealand Meat and Wool Board Economic Service

The rural zone covering 94% of the land in the Hastings district is orientated towards pastoral farming, with an increasing diversification into dairying and forestry.

Wool and sheep meat production are also the principal activities in Central and Southern Hawke’s Bay. Beef production and cropping are undertaken where soil type and water resources permit; a trend to dairy production has become evident. Increasing areas of land are being used for deer farming and horticulture and areas of forestry have been established.

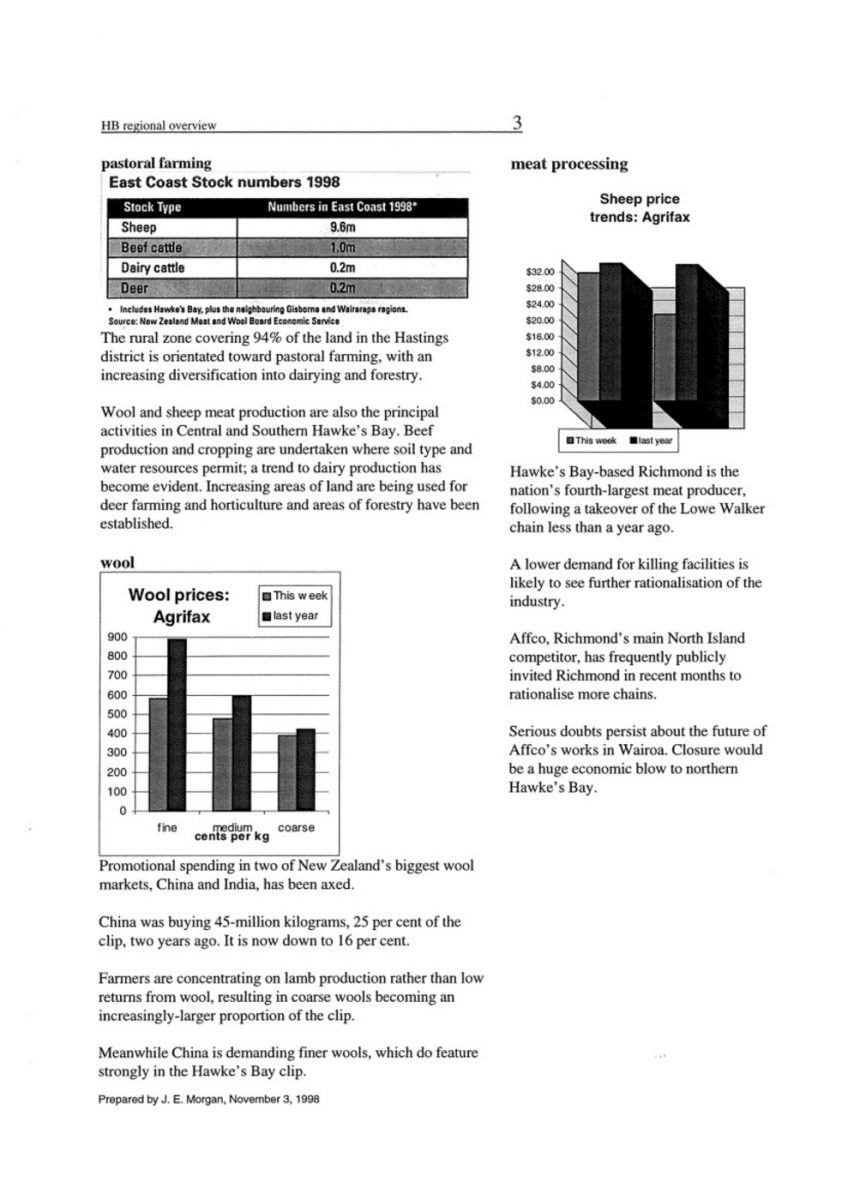

wool

Promotional spending in two of New Zealand’s biggest wool markets, China and India, has been axed.

China was buying 45-million kilograms, 25 per cent of the clip, two years ago. It is now down to 16 per cent.

Farmers are concentrating on lamb production rather than low returns from wool, resulting in coarse wools becoming an increasingly-larger proportion of the clip.

Meanwhile China is demanding finer wools, which do feature strongly in the Hawke’s Bay clip.

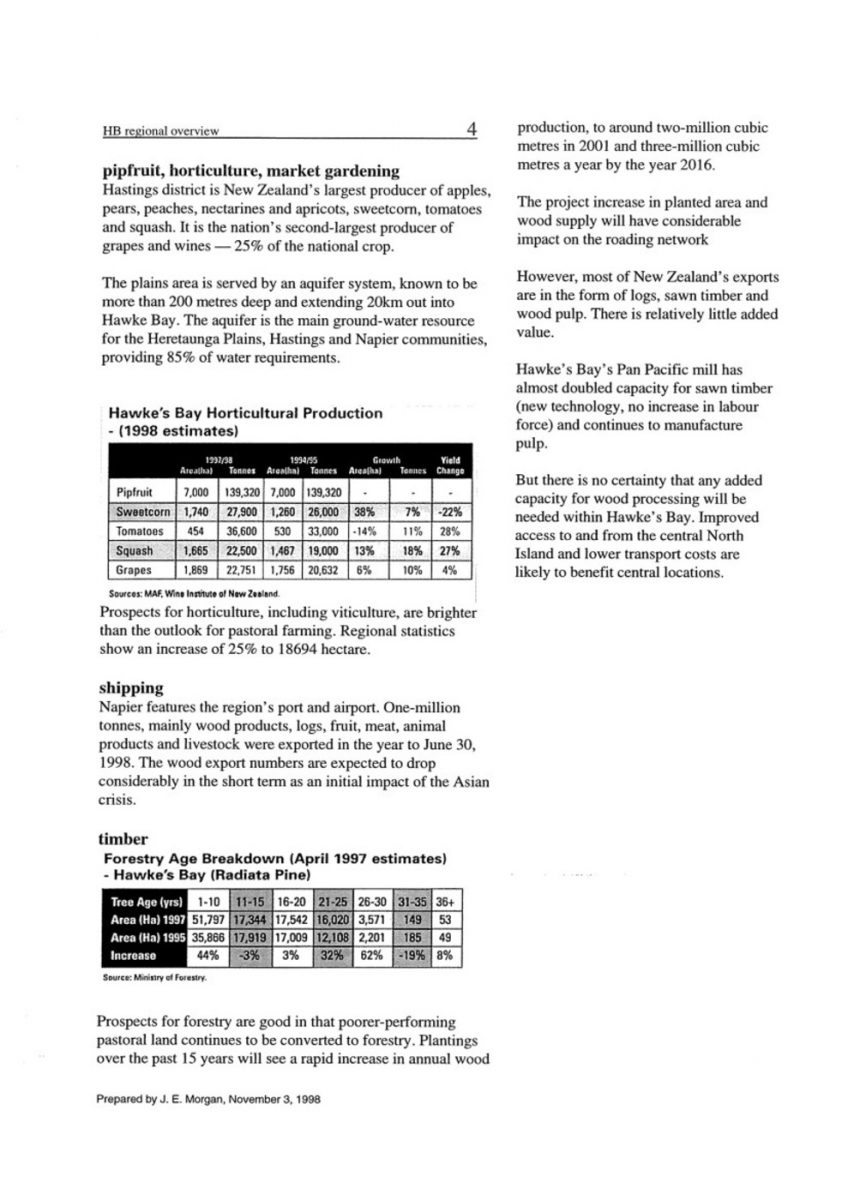

Meat processing

Hawke’s Bay-based Richmond is the nation’s fourth-largest meat producer, following a takeover of the Lowe Walker chain less than a year ago.

A lower demand for killing facilities is likely to see further rationalisation of the industry.

Affco, Richmond’s main North Island competitor, has frequently publicly invited Richmond in recent months to rationalise more chains.

Serious doubts persist about the future of Affco’s works in Wairoa. Closure would be a huge economic blow to northern Hawke’s Bay.

Prepared by J. E. Morgan, November 3, 1998

HB regional overview 4

pipfruit, horticulture, market gardening

Hastings district is New Zealand’s largest producer of apples, pears, peaches, nectarines and apricots, sweetcorn, tomatoes and squash. It is the nation’s second-largest producer of grapes and wines – 25% of the national crop.

The plains area is served by an aquifer system, known to be more than 200 metres deep and extending 20km out into Hawke Bay. The aquifer is the main ground-water resource for the Heretaunga Plains, Hastings and Napier communities, providing 85% of water requirements.

Hawke’s Bay Horticultural Production – (1998 estimates)

1997/98 1994/95 Growth Yield

Area(ha) Tonnes Area(ha) Tonnes Area(ha) Tonnes Change

Pipfruit 7,000 139,320 7,000 139,320 – – –

Sweetcorn 1,740 27,900 1,260 26,000 38% 7% -22%

Tomatoes 454 36,600 530 33,000 -14% 11% 28%

Squash 1,665 22,500 1,467 19,000 13% 18% 27%

Grapes 1,869 22,751 1,756 20,632 6% 10% 4%

Sources: MAF, Wine Institute of New Zealand.

Prospects for horticulture, including viticulture, are brighter than the outlook for pastoral farming. Regional statistics show an increase of 25% to 18694 hectare.

shipping

Napier features the region’s port and airport. One-million tonnes, mainly wood products, logs, fruit, meat, animal products and livestock were exported in the year to June 30, 1998. The wood export numbers are expected to drop considerably in the short term as an initial impact of the Asian crisis.

timber

Forestry Age Breakdown (April 1997 estimates) – Hawke’s Bay (Radiata Pine)

Tree Age (yrs) 1-10 11-15 16-20 21-25 36-30 31-35 36+

Area (Ha) 1997 51,797 17,344 17,542 16,020 3,571 149 53

Area (Ha) 1995 35.866 17,919 17,009 12,108 2,201 185 49

Increase 44% -3% 3% 32% 62% -19% 8%

Source: Ministry of Forestry.

Prospects for forestry are good in that poorer-performing pastoral land continues to be converted to forestry. Plantings over the past 15 years will see a rapid increase in annual wood production, to around two-million cubic metres in 2001 and three-million cubic metres a year by the year 2016.

The project [projected] increase in planted area and wood supply will have considerable impact on the roading network

However, most of New Zealand’s exports are in the form of logs, sawn timber and wood pulp. There is relatively little added value.

Hawke’s Bay’s Pan Pacific mill has almost doubled capacity for sawn timber (new technology, no increase in labour force) and continues to manufacture pulp.

But there is no certainty that any added capacity for wood processing will be needed within Hawke’s Bay. Improved access to and from the central North Island and lower transport costs are likely to benefit central locations.

Prepared by J. E. Morgan, November 3, 1998

HB regional overview 5

commodity prices

The short-term outlook for New Zealand agriculture is one of slow recovery of product prices from a low base.

Sheepmeats, beef, venison and wool are expected to improve marginally. Dairy prices are likely to remain static for the next 2-3 years. Any substantial movement in product prices will have to come from improved marketing.

Given the present uncertain future of producer boards, with it collectively their ability to market New Zealand produce, it would be unwise to count on a noticeable improvement in marketing over the next couple of years.

drought impact

Last year’s drought, which caused heavy destocking of Hawke’s Bay farms is replicating itself. The water and atmospheric research institute’s October 1998 weather summary shows Hawke’s Bay having less than a third of normal rainfall and a marked drop in soil moisture.

Environmental officers report groundwater levels starting their steep summer drop six weeks early. Process crop growers are reporting paddocks too dry to sow seed.

Farmers, with stock depleted from last year’s drought, are quitting even more animals.

Ministry of Agriculture estimates the loss from pastoral farming and dairying at $30-million in Hawke’s Bay for 1997/98 and estimates the loss for 1998/99 at $75-million.

tourist visitors

Hawkes Bay Visitor Industry Indicators

Indicator year to

Dec 96 May 98

Domestic visitor numbers 499,777 514,537

Domestic visitor nights 1,485,723 1,539,319

Average length of stay – domestic (nights) 2.97 3.0

Average daily expenditure – domestic $60 NZ $138 NZ

Total Domestic Visitor Spend $89.1m $212.4m

International visitor numbers 84,698 70,000

International visitor nights 334,351 216,000

Average length of stay – international (nights) 3.95 3.1

Average daily expenditure – international $130 NZ $187 NZ

Total International Visitor Spend $43.5m $39.5m

Source: ‘Napier/HB Visitor Monitor’, Napier City Council.

HB regional council invests $225,000 a year in regional tourism promotion.

Napier benefits from the post-1931 earthquake architecture, when the widespread use of Art Deco style introduced an added attraction for tourism.

Both cities benefit from the wine trail and the Cape Kidnappers land-based gannet colony.

Hastings’s nationally-known Fantasyland is currently undergoing a $6-million refurbishment which will introduce lazy-river rides, hot pool and ice-skating features.

There has been a steady increase in international visitors, reflecting the New Zealand trend at the lower level.

HB regional overview 6

Housing starts [stats]

% of House Sales in Each Price Category – Relative to Other Selected Regions July 1998

Price Range (000’s) Hawke’s Bay% Auckland% Wellington% Waikato/Bay of Plenty% Nelson/Marlborough% New Zealand Total %

<100 32 1 20 19 9 20

$100-200 57 35 48 56 73 45

$200-300 8 39 20 20 14 23

$300-400 3 15 9 3 3 7

$400+ 0 10 3 2 1 5

Median House Price $118,000 $225,500 $168.000 $152,250 $136,000 $165,000

July 1998

Median House Price

Napier City $134,000

Hastings City $113,500

Hawke’s Bay Total $118,000

Source: Real Estate Institute of New Zealand

Household occupancy has been steadily falling in Hawke’s Bay. It is down from an average of 3.1 in 1986, to 2.9 in 1991, to 2.8 in 1996. This is less than the national average of 2.85.

This has had an effect, however, on housing stock. In the 10 years to 1996 there has been an increase of 5459 households.

Occupied dwellings

Council 1986 1991 1996 10-year increase growth share

Hastings 20,769 22,071 23,312 2543 47.2%

Napier 17,859 18,845 20,169 2310 42.9%

Central HB 4,205 4362 4,598 393 7.3%

Wairoa 3,191 3319 3,333 142 2.6%

Lower interest rates in New Zealand are expected to help house building but the effects are not expected to filter through till 1999.

employment

Hawke’s Bay’s population is both older and younger than the New Zealand average.

It has a higher proportion of children – 25% of its population is under 15 years, compared with a national average 23%. It has a lower proportion of population in the working years.

And, again, 25% of the population is aged 50 years or more, compared with 24% for New Zealand.

Hawke’s Bay has a considerably greater proportion of people of the New Zealand Maori ethnic group (16.7%) compared with New Zealand (10.4%)

Labour market conditions remain weak. In October, the ANZ survey suggested that the labour market will bottom out toward the end of this year or early into next year.

At the moment, however, the number of jobs ads appearing is down by 19 per cent.

The primary sector is forecast to experience average growth in output, with higher growth in forestry, average growth in agriculture and low growth in fishing. The overall contribution of the primary sector to growth in employment will be modest because it is a small sector in employment terms.

Employment in food processing is forecast to be slow growing.

Some growth can be attributed to tourism the service sector working in the export area.

Without diversification, a Hawke’s Bay economy based on pastoral agriculture and meat is expected to experience weak growth.

Currently unemployment rates are similar to the New Zealand average. At best, employment growth predictions for Hawke’s Bay to the year 2001 are 7% for all sectors.

Prepared by J. E. Morgan, November 3, 1998

Non-commercial use

This work is licensed under a Attribution-NonCommercial 3.0 New Zealand (CC BY-NC 3.0 NZ).

Commercial Use

Please contact us for information about using this material commercially.Can you help?

The Hawke's Bay Knowledge Bank relies on donations to make this material available. Please consider making a donation towards preserving our local history.

Visit our donations page for more information.

Do you know something about this record?

Please note we cannot verify the accuracy of any information posted by the community.